Adobe: Paid Search Opportunities Lie In Tablet Targeting And PLAs

Where are the bargains in paid search these days? According to an analysis of the fourth quarter in paid search, Adobe determined that both tablet targeting and product listing ads represent great opportunities for marketers, where there’s a substantial gap between cost-per-click (CPC) and conversion rate. Adobe came to its conclusions after looking at paid […]

Where are the bargains in paid search these days? According to an analysis of the fourth quarter in paid search, Adobe determined that both tablet targeting and product listing ads represent great opportunities for marketers, where there’s a substantial gap between cost-per-click (CPC) and conversion rate.

Adobe came to its conclusions after looking at paid search spend across more than 2 billion impressions by its clients in the fourth quarter. Adobe’s Media Optimizer unit came from the company’s acquisition of paid-search-specific company Efficient Frontier.

Paid search as a whole had a good holiday season, Adobe found, with spend by online retailers up 16% year-over-year. Last year, the rise from fourth quarter 2011 to 2012 was just 13%.

Google saw its market share rise to 86.5% percent, up from 85.9% in Q4 2011. This increase was directly related to the opportunities for marketers — mobile traffic and the creation and growth of product listings ads.

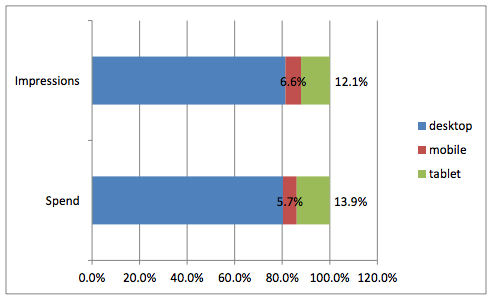

Adobe researchers have found that mobile traffic is growing much more quickly than expected. Mobile, including both smartphones and tablets, now represents 20% of spend and impressions in paid search — double the amount of traffic from a year ago.

Some of that is due to what Sid Shah, director of business analytics at Adobe, calls the Christmas Effect — when people open up holiday gifts of new tablets. “What’s really interesting,” said Shah, “is that on Christmas Day and Christmas Eve mobile traffic spikes up and remains high for the entire holiday period. We see a very similar trend globally.” By the end of next year, Shah expects mobile devices to account for 30 to 35% of paid search traffic, with a good amount of that growth occurring between Christmas and the end of the year, when new tablets and smartphones are unwrapped.

Though traffic has been high and conversion rates on tablets have been high, these tablet-targeted campaigns have benefited from a 30% lower CPC than desktop campaigns, meaning they resulted in a 73% higher ROI. That changed slightly in Q4, as marketers began to see the opportunity and bid higher on tablets. During that period, Adobe found, tablet CPCs were only 16% lower than desktops. Still, with higher conversion rates, tablets represent an opportunity.

Shah notes that many marketers may be targeting tablets or smartphones, but aren’t necessarily ensuring that their campaigns are optimized for mobile — with mobile-specific creative and landing pages — and doing so, or at least testing this approach, would be worthwhile.

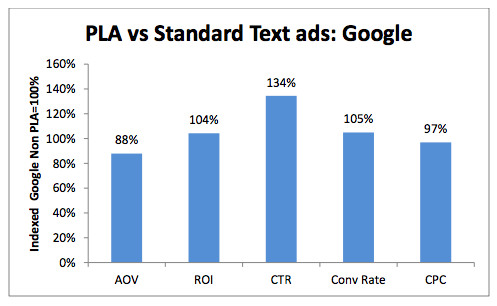

Likewise, product listing ads — which now represent all of Google Shopping results — were a major factor this holiday season. Adobe found that PLAs accounted for 10.7% of overall paid search spend in Q4. By contrast, Bing’s whole paid search program represented only 13.8% of retail ad spend.

Adobe noticed some interesting trends around PLAs as compared to regular paid search ads. PLAs have a 34% higher CTR than non-PLA ads, which makes sense given the larger space and image afforded to the PLAs. However, the average order value for PLA ads is 12% lower than standard ads. Shah believes this is because users looking at PLAs, especially on Google Shopping, could be more price-sensitive, using the ads to do price comparison. Those clicking on non-PLA ads could be impulse buyers who aren’t shopping around as aggressively.

Additionally, Shah told me that non-PLA ads often benefit from a lift caused by view-throughs of PLA ads. In other words, people see a PLA ad for a certain brand or product, and then, as they continue searching, they later click on a regular text ad. “Fifteen to twenty percent of all clicks that begin with a PLA ad end with a non-PLA ad,” Shah said. With regular paid search ads, there’s only a 5 to 10% lift effect.

Though PLAs are now priced rationally, as compared to paid text ads, Shah suggests that making PLAs more granular — making them for more products in more categories — is an opportunity for advertisers. Additionally, he believes getting the team working on PLAs collaborating with the paid search group — if they aren’t already — could bring marketers more value. Additionally, investing in technology that allows for more precise attribution could enable marketers to track and capitalize on the lift effect.