U.S. paid search spend forecast to hit $110 billion in 2023

Within search, retail media networks (RMNs) are a rising star – it is projected to be near $30 billion in spending this year.

Paid search spend is expected to reach $110 billion this year, according to a new eMarketer forecast.

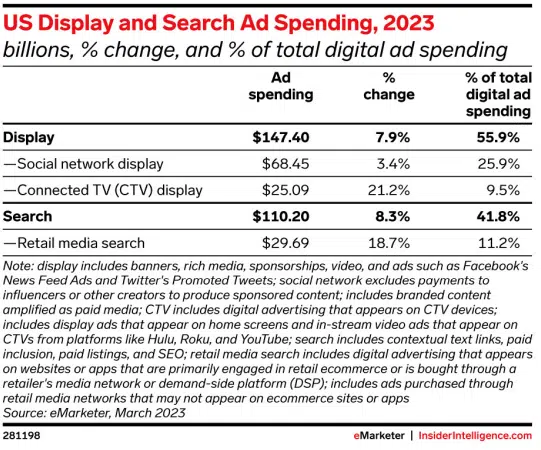

Search and retail media. Paid search represents 41.8% of total digital spending. If it reaches $110 billion, its growth will remain slightly higher (at 8.2%) than overall U.S. digital ad spend, which is expected to increase by 7.8%.

Within search, retail media networks (RMNs) are a rising star, with 18.7% growth in retail media search. This segment is projected to be near $30 billion in spending in 2023.

RMN digital ad revenue (not just in search) is on course to rise from $31 billion in 2021 to $45 billion this year. If spending continues at its current rate it should surpass $106 billion in 2027.

Why we care. We expect 2023 to be a challenging year in search. There have been many changes related to generative AI and chat in search (both on Google and Microsoft Bing), and we’re hoping to get more clarity soon about what these changes will mean in terms of engagement and ad performance. Until then, it’s good to see overall paid search spend growth rising – especially in retail.

More on U.S. search ad revenue. It hit a record $84.4 billion in 2022, according to IAB.

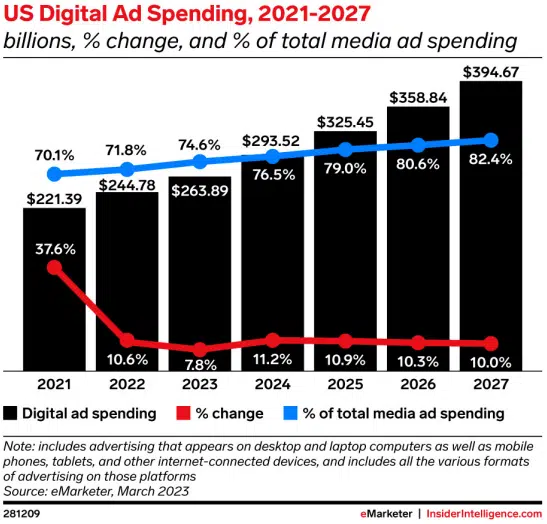

U.S. digital ad spend. While it’s dropping below 10% for the first time in 14 years, digital ad spending is projected to rebound to 11.2% growth in 2024, the forecast said. Yearly increases are predicted to hover around 10% through 2027.

Digital ad spend saw a dramatic rebound in 2021 following the initial wave of the COVID pandemic — when it saw growth of 37.6%. In 2022, the numbers fell dramatically, with 10.6% growth.

Digital slice of the pie. Overall media spending is expected to increase 3.8% this year as traditional media investments continue to migrate to digital.

Digital media should make up 74.6% of total U.S. media spend, which is expected to reach nearly $264 billion in 2023. The digital slice of total media spending is projected to grow about 2% annually in the coming years.

Display and CTV. Connected TV (CTV) advertising keeps charging ahead.

For some perspective, over half (55%) of digital spending is in display ads whose revenue is expected to grow 7.9% this year. CTV’s projected growth for 2023, however, is 21.2% – nearly triple digital’s growth.

CTV ad spend is on pace to hit $25 billion this year and account for 9.5% of total digital ad revenue, according to eMarketer.

Social display, on the other hand, is projected to only see a growth increase of 3.4% in 2023. Social network display advertising is about a quarter of total digital spending.