How analyzing search data can improve your decision-making

Search data provides a wealth of insights for marketers. At SMX Next, Matt Colebourne shows how to use this information to make better business decisions.

“Just as you have the winners and the losers in the physical space, you have the same in the digital space; page two of Google or any search engine is fundamentally the ‘backstreet,’” he said. “That’s where a lot less audience is going to end up.”

Marketers have long used search data to optimize their content so it meets user needs. But many fail to apply those same insights to inform decisions that impact the long game.

“A lot of companies make the mistake of optimizing for growth way too soon,” Colebourne said. “They settled for their current product set and their question becomes, ‘How can we optimize sales of what we have?’ Whereas the questions they should be asking are, ‘What are the sales that we could have? How much of our target market do we have right now?’”

Each day Google processes over 3.5 billion searches, which provides marketers with a wealth of data. Here are three reasons why analyzing this search data improves marketers’ decision-making processes.

Search data shows where your growth is coming from

“Currently, about 15% of search terms that appear on Google every month are new,” said Colebourne, “So, that starts to give you an inkling of the pace of change that we have to deal with. We see trends come and go in months, and some cases even weeks. And as businesses, we have to respond.”

Many organizations focus too much energy on driving growth while neglecting to determine where that growth is coming from. And in this digital age, there’s a good chance much of it is coming from search. This data offers marketers valuable insights, especially those relating to their industry segment.

“You have to understand how your industry and category is structured and ask the right questions,” he said. “If, for example, you sell specialty sports shoes, it doesn’t make a lot of sense to compare yourselves with Nike or similar companies who have much much bigger coverage, but may not be leaders in certain segments.”

It helps address your most significant decision-making challenges

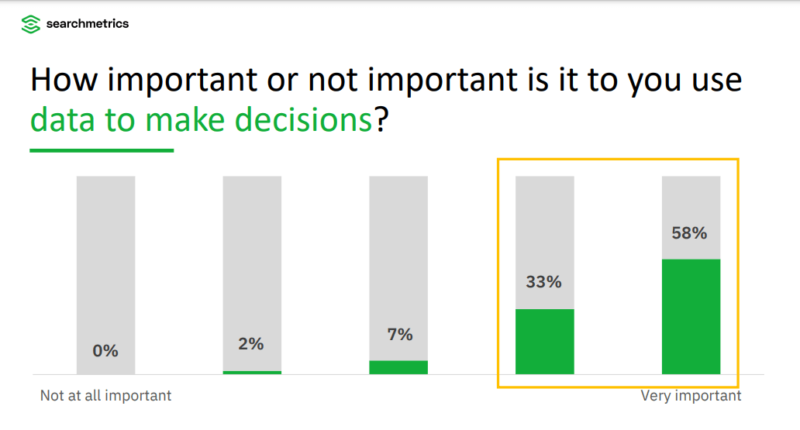

Data — specifically search data — should be part of any company’s core decision-making process. To show how often brands use it, Colebourne highlighted a survey from Alpha (now Feedback Loop) that asked 300 managers how they made decisions.

“The question they asked was, ‘How important or not important is it to you to use data to make decisions?’” said Colebourne. “And I think nobody is going to be surprised by the results — 91% think data-driven decision-making is important . . . But the corollary to this question was, ‘How frequently or infrequently do you use that?’”

The answer was just 58%.

Clearly, knowing search data is valuable isn’t enough to be successful — marketers need to use these insights from searchers to make better business decisions. Otherwise, they’re going to miss out on a good source of traffic insights.

“65% of all e-commerce sessions start with a Google search,” Colebourne said. “I would argue that makes it a good source for decision-making. It’s a massive sample set, completely up to date, and it’s continually refreshed.”

Search data gives you more consumer context

“That [search] data — sensibly managed and processed — can show you the target market and provide you with the consumer demand,” said Colebourne. “It can show you if the market is growing or contracting.”

Analyzing search data can give marketers a clearer view of their consumers, especially for those groups they haven’t reached yet. Reviewing what people are searching for, how often they’re searching and how your competitors are addressing the challenge can make decision-making that much easier.

But more than that, marketers must look at the marketplace as a whole, using search data to inform decision-making.

“We’re all very focused on keywords and rankings and all these good things that we know how to manage,” Colebourne said. “But what we need to do is step beyond that and not just look at what we have or what competitors have, but look at the totality of the market.”